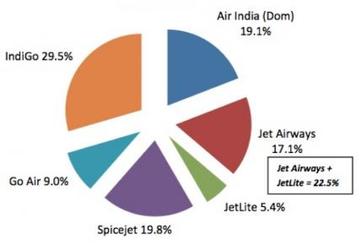

In air transport, India can be considered as an Eldorado. Yet, very few Indian airlines derive financial benefit. Let's try to analyze why, by shedding light on this market. Six major airlines are operating in India. Their respective market shares are the following: • Air India 19.1% • Go Air 9.0% • Indigo 29.5% • Jet Airways 17.1% • Jet Lite 5.1% • SpiceJet 19.8% Source : Directorate General of Civil Aviation - May 2013 Air India, state-owned airline, accused a US$ 1.4 billion deficit at the end of 2012 and must be supported regularly by the central state. Jet Airways ( Jet Airways +Jet Lite) group has hardly been a profitable for the last 5 years. At the end of 2012, it had a deficit of US$ 250 million to an income of about US$ 3 billion. SpiceJet was in deficit of US$ 109 million for a turnover of 720 million US$ in 2012. Following the recent departure of its CEO , SpiceJet has the opportunity to renew its management team and restore confidence. Go Air has lost US$ 24 million for US$ 278 million sales in 2012. Go Air is still in deficit but approaches equilibrium. Indigo seems healthier than its competitors, with a profit of US$ 23 million for an income of US$ 1 billion in 2012. How to explain the relative success of Indigo ? The fill rate at Indigo is more than 80 % while it is between 65% and 75% for other airlines. The "pitch" (the difference between two rows of seats ) is 76 cm in Indigo Airbus A320 when it goes up to 81cm on Air India or Jet Airways B737 A320 . More seats in tight rows , and especially a better fill rate than its competitors thus explain the relative success of Indigo . "Low Cost" a Key Success Factor in India? Indeed , Indian specificity 2/ 3 of the market in the hands of " Low Cost Carriers" ( Indigo , Jet Airways , Go Air, SpiceJet ). Only Air India and Jet Airways are still operating as "Full Service Carriers". One the most significant event of the year 2013, was the bankruptcy of Kingfisher, a full service airline. It underlined the fragility of the sector. The airline , however, was the largest in the country less than two years earlier and had an excellent reputation among passengers . Kingfisher 's bankruptcy underscores the appetite of the Indian consumer ( including passengers ) towards low prices. The average annual per capita GDP is just over 1000 Euro . Each rupee is valuable ... In this country of 1.3 billion people , there are only 60 million domestic passengers in 2012. The vast majority of the population have therefore never flew . Other factors impacting air transport market ? Actually, this market is highly regulated by the government. The price of kerosene is burden by more severe taxes than in other countries. Airport infrastructure are still largely in the making, although efforts have been made in the last five years ( including Delhi). Faced with the difficulties of the actors and a promising market , the Indian government decided in September 2012 to review the law on foreign direct investment (FDI : Foreign Direct Investment). The government now allows foreign investors to own up to 49% of the share capital of Indian airlines. The change in legislation has opened the ball of contenders ... TaTa Sons will soon be present in the capital of two new entrants. First Air Asia India, low-cost company and also a joint venture with Singapore Airlines that will provide a comprehensive and high quality service. Some may see it as a contradiction. Tata not see any. Both offers are aimed at very different segments of the market. Analysts are questionning the viability of the project of alliance between TaTa Sons and Singapore Airlines in launching an airline rather " premium". While the low-cost airline Air Asia India, might be gain a large market share. However, the Indian group TaTa already sees opportunities to streamline aircraft maintenance. Translated from French by Frederic Gayraud, PRADO CONSULTING Published on Le Cercle Les Echos  The sale of Rafale aircraft fighters by Dassault Aviation from France to India is accompanying the diversification of the largest Indian conglomerate into the aerospace and defense industry . In early 2012, the Indian Ministry of Defence has announced the selection of the Rafale from Dassault Aviation as part of the tender MMRCA (Medium Multi-Role Combat Aircraft). Actually, this is a round of privileged but delicate negotiations between the French aircraft manufacturer and the Indian authorities. The MMRCA tender is estimated at 10 billion euros for the supply of 126 fighter aircrafts. One of the constraints imposed on this contract is an obligation to offset up to 50%. The Indian aerospace industry will therefore benefit from a windfall of nearly 5 billion euros in the coming years. Beyond this agreement, India is now the world's largest importer of weapons and plans to invest nearly $ 100 billion in defence equipments, in the next ten years. The aviation industry in this country mainly revolves around the state owned group HAL (Hindustan Aeronautics Limited). HAL is not completely able to match the capabilities needed to build an aircraft such as the Rafale. Dassault Aviation will also provide technology transfer to other indigenous companies. Fifteen days after the announcement of the choice of the Rafale, Dassault Aviation and the Indian conglomerate Reliance Industries (RIL) announced a partnership in the fields of defense and security, but the two groups did not say more about the scope of this agreement. RIL is the first private Indian group; it is present in the gas, petrochemicals but also textile fibres, distribution and telecommunications but not in aerospace. The Reliance Group has annual revenues of approximately U.S. $ 70 billion and has the largest market capitalization in the Mumbai Stock Exchange. Reliance is led by Mukesh Ambani, listed as the 9th richest man in the World and is the son of the founder of RIL – Dhirubhai Ambani. Mukesh Ambani has a dream to create an Indian Boeing, and now he has embarked on his journey towards this goal, with the reliance fortune. In 2011, he hired Dr. Vivek Lall to be the head of Reliances’ aerospace division: Dr. Vivek Lall is a recognized expert in the world of aerospace. Dr. Lall studied in the United States and has worked for NASA, Raytheon and Boeing. He was the managing director of Boeing in India before joining the Reliance Group. In February 2012, RIL announced a partnership with Dassault Aviation. In early summer 2012, RIL applied to the Indian Ministry of Commerce and the economy, for an industrial license to produce aircraft parts and to develop aerospace technologies. This was followed by the creation of Reliance Aerospace Technologies and Homeland Security, for which Vivek Lall was appointed CEO. HQ of the Aeronautics Division of the Reliance Group is based in Nashik, near Mumbai. RIL plans to acquire other facilities across the country in order to create a real Aerospace hub. RIL would also unite smaller players and train them to produce better quality components for the aviation industry. Mr. Ambani plans to invest up to 1 billion U.S. $ and hire nearly 1,500 employees in the coming years in its aerospace division. While the Reliance Group's cash is important, it is necessary to show some courage to embark on such an adventure. Reliance Group has experienced several transformations in its history. The future will tell us if the bet on the aerospace industry will be successful. (Translated from French by Frédéric GAYRAUD & Neha SHRIVASTAVA). Published on Le Cercle Les Echos |

AuthorFrédéric Gayraud, regularly consults with major international companies. He leads seminars for senior executives, works on strategy & market research and supports clients during M&A. Archives

January 2018

Categories

All

|

RSS Feed

RSS Feed